BTC Price Prediction: Key Factors Driving the Next Rally

#BTC

- Technical Strength: Price holding above key moving averages with improving momentum indicators

- Institutional Adoption: Major corporations and funds increasingly adding BTC to treasuries

- Regulatory Tailwinds: Growing legislative acceptance for Bitcoin in traditional finance

BTC Price Prediction

BTC Technical Analysis: Bullish Signals Emerge

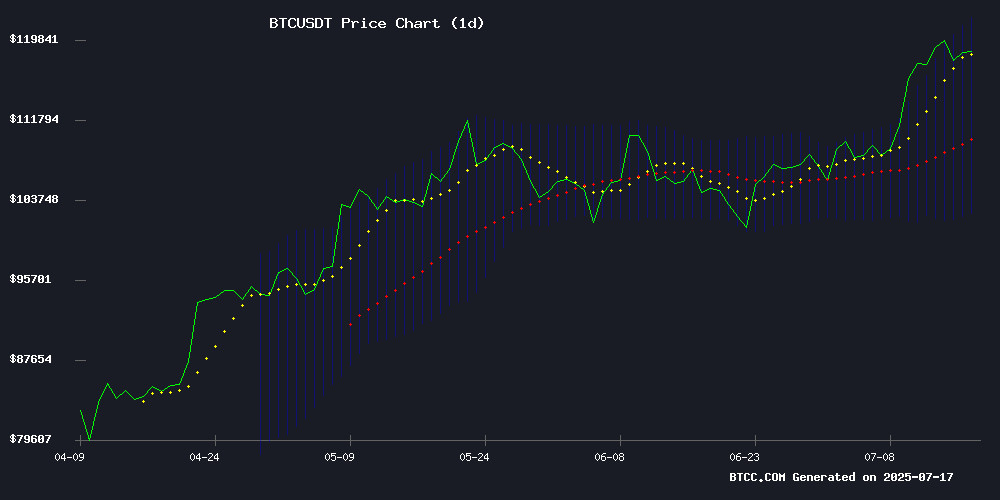

According to BTCC financial analyst Michael, BTC is currently trading at 119,255.99 USDT, above its 20-day moving average (MA) of 112,312.20, indicating a bullish trend. The MACD histogram shows a narrowing bearish momentum at -1,236.10, while the price sits comfortably above the middle Bollinger Band (112,312.20), suggesting potential upward movement if it breaches the upper band at 122,236.67.

Market Sentiment Turns Bullish as Institutional Interest Grows

BTCC's Michael highlights strong positive sentiment driven by headlines like Volcon's $500M Bitcoin treasury bet and BSTR becoming the 4th largest public BTC holder. Regulatory developments (U.S. lawmakers proposing BTC in mortgages) and corporate adoption (MicroStrategy's 3,558% surge) are fueling institutional demand, with BTC recently surpassing $123K.

Factors Influencing BTC’s Price

Volcon, Inc. (VLCN) Stock Soars 203% on $500M Bitcoin Treasury Bet

Volcon, Inc. (NASDAQ: VLCN) experienced a meteoric rise, surging over 203% intraday following its announcement of a $500 million private placement to acquire Bitcoin. The stock opened sharply higher, briefly touching $60 before stabilizing near $28 in late morning trading. This strategic pivot positions Bitcoin as the company’s primary treasury reserve asset, marking a decisive shift away from traditional fiat holdings.

The electric vehicle manufacturer confirmed the sale of over 50 million shares at $10 each to institutional and accredited investors, with gross proceeds expected to exceed $500 million. The transaction, led by Empery Asset Management and joined by crypto-focused participants, is set to close by July 21, 2025. The capital will fuel a Bitcoin-centric reserve strategy, accelerating corporate adoption of digital assets.

Market observers note the move reflects growing institutional confidence in Bitcoin as a treasury asset. Volcon’s dramatic stock performance underscores the market’s appetite for companies embracing cryptocurrency strategies, even as the EV sector faces headwinds.

BSTR to Launch as 4th Largest Public Bitcoin Holder with 30,021 BTC

BSTR Holdings Inc. is poised to become a major player in corporate Bitcoin adoption, announcing its public debut with 30,021 BTC on its balance sheet. The company will go public via a SPAC merger with Cantor Equity Partners I, Inc., backed by Cantor Fitzgerald. This positions BSTR as the fourth-largest public Bitcoin holder, trailing only MicroStrategy, Marathon Digital, and Hut 8.

The deal includes up to $1.5 billion in PIPE financing—the largest ever for a Bitcoin Treasury SPAC—and an additional $200 million from the SPAC itself. Led by Blockstream CEO Dr. Adam Back, BSTR’s structure as a dedicated Bitcoin treasury vehicle signals institutional confidence in BTC as a reserve asset.

The listing, expected under ticker BSTR, arrives amid surging institutional interest following the approval of Bitcoin and Ethereum ETFs. This merger not only accelerates corporate Bitcoin adoption but also highlights SPACs’ growing role in bridging crypto and traditional finance.

6 Best Cloud Mining Apps for Passive Bitcoin Income in 2025

Cloud mining has democratized Bitcoin earnings, eliminating the need for expensive hardware or technical expertise. Platforms like AIXA Miner now enable users to generate passive crypto income through smartphone apps, leveraging enterprise-grade mining infrastructure.

The sector has matured significantly since 2020, with regulatory compliance becoming a key differentiator. AIXA Miner's recent FinCEN MSB licensing underscores this trend, offering U.S.-based investors a compliant pathway to Bitcoin rewards without equipment maintenance.

Modern cloud mining solutions promise seamless operation - users simply activate plans through intuitive interfaces while algorithms optimize hash power allocation. This represents a paradigm shift from the energy-intensive mining operations of previous decades.

U.S. Lawmakers Propose Including Bitcoin in Mortgage Evaluations

Representative Nancy Mace introduced H.R. 4374, a bill that would require mortgage lenders to consider Bitcoin and other cryptocurrencies when assessing borrower eligibility. The legislation targets outdated underwriting systems that currently ignore digital assets held in brokerage accounts.

The proposed changes could significantly expand homebuying opportunities for crypto holders. Veterans stand to benefit disproportionately, with the bill explicitly allowing VA-backed loans to count cryptocurrency holdings toward mortgage qualifications.

This move reflects growing institutional recognition of digital assets as legitimate financial instruments. The bill's passage would force updates across multiple government agencies, potentially accelerating mainstream adoption of cryptocurrency in traditional finance.

Michael Saylor Reveals Bitcoin Secret as MSTR Surges 3,558%

MicroStrategy executive chairman Michael Saylor has reignited his bullish Bitcoin rhetoric, revealing what he terms the "ultimate Bitcoin secret" alongside staggering performance metrics. The company's stock (MSTR) has outpaced Bitcoin itself—delivering a 3,558% return over five years compared to BTC's 905% gain.

MicroStrategy now holds 601,550 BTC valued at over $73 billion, cementing its position as the largest corporate Bitcoin treasury. Saylor's mantra—"The only thing better than Bitcoin is more Bitcoin"—reflects an uncompromising accumulation strategy that has dwarfed traditional assets like gold (+62%) and the S&P 500 (+86%).

The crypto community continues debating Saylor's maximalist approach as MicroStrategy leverages its premium market position. With a $116 billion market cap, the firm has effectively become a leveraged Bitcoin proxy for institutional investors.

Pakistan and El Salvador Forge Bitcoin Partnership Amid IMF Resistance

Pakistan has entered a landmark collaboration with El Salvador to bolster its Bitcoin reserves, marking a strategic pivot toward cryptocurrency adoption. The partnership focuses on knowledge transfer from El Salvador's successful Bitcoin accumulation model, including regulatory frameworks and public-sector utility exploration.

Despite opposition from the IMF—which blocked Pakistan's proposed electricity subsidies for Bitcoin mining—the country plans to establish a Strategic Bitcoin Reserve. El Salvador, holding over 6,200 BTC with substantial unrealized gains, serves as both a technical advisor and proof of concept for state-level crypto adoption.

The alliance signals growing institutional recognition of Bitcoin's role in economic resilience, particularly for emerging markets. Both nations aim to expand their holdings in coming months, defying traditional financial institutions while exploring crypto-based public infrastructure.

The Crypto Market Resurgence: Will the Rally Hold or Reverse?

Bitcoin's recent 10% surge to near $123,000 has sparked debate among analysts, with some like Capo warning of an impending correction. Despite the bullish momentum, Capo maintains a bearish stance, suggesting the rally may be unsustainable. "The enthusiasm surrounding BTC is evident," he noted, while revealing his short positions remain intact due to low leverage.

Market risks loom as Bitcoin diverges from weakening traditional financial markets. Capo cautions against potential black swan events that could disrupt crypto's upward trajectory. The analyst's contrarian view contrasts sharply with prevailing optimism in digital asset markets.

Ex-NCA Officer Sentenced for Stealing Bitcoin in Silk Road 2.0 Case

Paul Chowles, a former National Crime Agency officer, has been sentenced to five and a half years in prison for stealing 50 Bitcoin worth $5.9 million during an investigation into Silk Road 2.0. The Crown Prosecution Service confirmed the sentencing on Wednesday.

Chowles was part of the team probing Silk Road 2.0, a successor to the original darknet marketplace. As lead analyst, he managed the seizure of 97 Bitcoin from co-founder Thomas White in 2014. Three years later, half the haul vanished—transferred to an external address and obscured using Bitcoin Fog mixer.

Blockchain analytics firm Chainalysis helped trace the illicit movement. Prosecutors described Chowles as a technically adept officer who exploited his position for personal gain, using specialized crypto debit cards to access the funds.

The theft initially raised suspicions against White, who maintained his innocence by revealing he no longer possessed the private keys. This admission triggered an internal investigation that ultimately exposed Chowles' scheme.

Bitcoin Surges Past $123K as Institutional Demand and Regulatory Clarity Drive Market Recovery

Bitcoin achieved a historic milestone on July 14, 2025, breaching $123,000 for the first time with a market capitalization exceeding $2.4 trillion—eclipsing Amazon to enter the global top-five asset rankings. The rally reflects a trifecta of bullish catalysts: regulatory progress, institutional adoption, and technical momentum.

The U.S. Congress ignited market optimism during "Crypto Week" by advancing two pivotal bills. The first clarifies jurisdictional boundaries between the SEC and CFTC, while the second creates a federal framework for stablecoins—measures poised to end years of regulatory ambiguity. Meanwhile, BlackRock's bitcoin ETF attracted $1.18 billion in weekly inflows, and public companies absorbed 131,000 BTC last quarter—institutional demand now outstrips daily mining supply by 20x.

Technical analysts note a "cup and handle" formation on monthly charts, with QCP Capital projecting a $135,000 target if regulatory clarity materializes. As traditional mining operations grapple with hardware obsolescence and energy costs, PAXMINING emerges as a leader in AI-driven cloud mining, leveraging clean energy solutions to serve 8 million users globally.

Is BTC a good investment?

Based on current technicals and market sentiment, BTCC's Michael considers BTC a compelling investment:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | +6.18% above | Bullish trend confirmed |

| MACD Histogram | -1,236.10 | Bearish momentum fading |

| Bollinger Position | Upper band 122,236.67 | Breakout potential |

News catalysts like institutional adoption and regulatory progress further support long-term upside.

1